IMF urges Uzbekistan to stick to foreign debt limits

The International Monetary Fund (IMF) has urged the government of Uzbekistan to strictly adhere to foreign borrowing limits and avoid procyclical fiscal policies, especially amid elevated global gold prices. According to international experts, maintaining macroeconomic stability will require sustained momentum in structural and institutional reforms.

Photo: Reuters

This recommendation comes as the IMF concluded its annual Article IV consultation with Uzbekistan.

Economic outlook remains stable

According to the IMF mission, Uzbekistan’s economic stability remains intact. GDP growth reached 6.5% in 2024 and 6.8% in the first quarter of 2025. The current account deficit is projected to narrow to around 2.6% of GDP, down from previous levels, thanks to increased remittances, growth in non-gold exports, positive trends in commodity prices, and the waning impact of one-off import surges in 2023. The country’s foreign exchange reserves remain at comfortable levels.

In 2024, the consolidated budget deficit decreased by 1.7 percentage points, down to 3.2% of GDP.

Despite ongoing uncertainty in global trade policy, the baseline scenario projects real GDP growth to remain steady at around 6% this year and next.

The IMF expects inflation to decline to the Central Bank’s target of 5% by the end of 2027, contingent on tight monetary policy and expenditure discipline.

Between 2025 and 2026, the current account deficit is expected to remain near or slightly below 5%, while foreign reserves may remain sufficient to cover 9.2 months of imports by the end of 2026.

Risks and opportunities

The IMF warned of several downside risks, including:

- Persistent and severe trade shocks

- Increased volatility in commodity prices

- Tighter external financing conditions

- Growing contingent liabilities from state-owned enterprises (SOEs), banks, and public-private partnerships (PPPs)

On the upside, opportunities stem from:

- Accelerated structural reforms

- Increased capital inflows and income

- Favorable trends in commodity prices

IMF recommendations

To support macroeconomic stability and promote sustainable, inclusive growth, the IMF made the following key recommendations:

- Continue structural and institutional reforms with the help of IMF technical assistance.

- Respect foreign debt limits and avoid procyclical spending, especially in light of high gold prices.

- Increase the tax-to-GDP ratio and improve public spending efficiency to create fiscal space.

- Strengthen commercial orientation and corporate governance of state-owned banks, while gradually phasing out directed and preferential lending.

- Complete price and trade liberalization, gradually withdraw support for SOEs, and accelerate privatization, aligning it with international best practices.

Related News

12:53 / 22.07.2025

Experts say IMF’s proposed pension model misfits Uzbekistan, warn against raising retirement age without public dialogue

12:12 / 18.07.2025

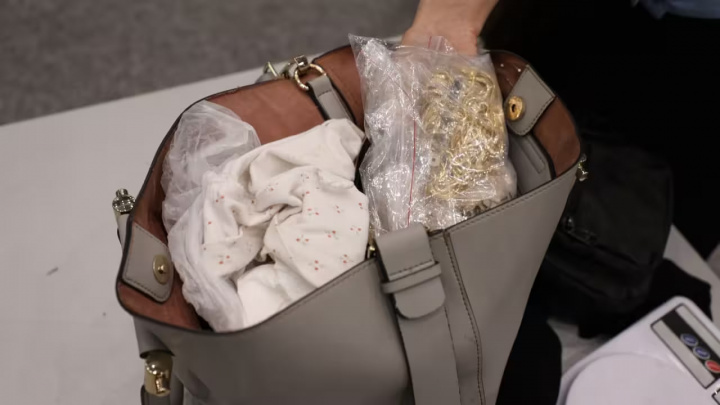

Gold smuggler detained at Fergana border post with UZS 5.2 billion in valuables

13:55 / 12.07.2025

Water debts of households and businesses in Uzbekistan near 800 Billion UZS

19:31 / 11.07.2025